The amount of car tax in Bangladesh depends on the type and size of the vehicle. For example, a small car would be taxed at a rate of 10 percent, while a large SUV would be taxed at a rate of 25 percent.

In Bangladesh, car tax is levied on the basis of engine capacity. For example, a car with an engine capacity of 1200cc or less will be taxed at a rate of 5%. A car with an engine capacity of 1201-1600cc will be taxed at a rate of 10%, and so on.

There are also additional taxes for luxury cars and imported cars.

কত CC এর গাড়িতে কত টাকা ট্যাক্স দিতে হয় // Car Import Tax in Bangladesh

How Much is Import Tax on a Car in Bangladesh?

Import taxes on cars in Bangladesh vary depending on the type of vehicle being imported. For example, passenger cars are subject to a 20% import duty, while commercial vehicles such as buses and trucks are subject to a 30% import duty. In addition to these duties, all imported vehicles are also subject to a value-added tax (VAT) of 15%.

How Much is Vat on Cars in Bangladesh?

In Bangladesh, the value-added tax (VAT) on cars is 15%. This means that if you purchase a car for BDT 1,000,000, you will need to pay an additional BDT 150,000 in VAT. The VAT is calculated based on the purchase price of the car and is applied at the time of purchase.

Why Car Tax is So High in Bangladesh?

In Bangladesh, car tax is high because the government imposes a luxury tax on vehicles. This tax is based on the engine size and fuel type of the vehicle. The luxury tax ranges from 5% to 20%, depending on the vehicle.

In addition to the luxury tax, cars are also subject to a registration fee and an import duty. The registration fee is 10% of the value of the vehicle, while the import duty is 30%.

The high taxes on cars in Bangladesh make it difficult for many people to afford a vehicle.

In addition, these taxes discourage people from buying cars, which results in less revenue for the government. The government should consider reducing these taxes in order to make owning a car more affordable for citizens and increase revenue from car sales.

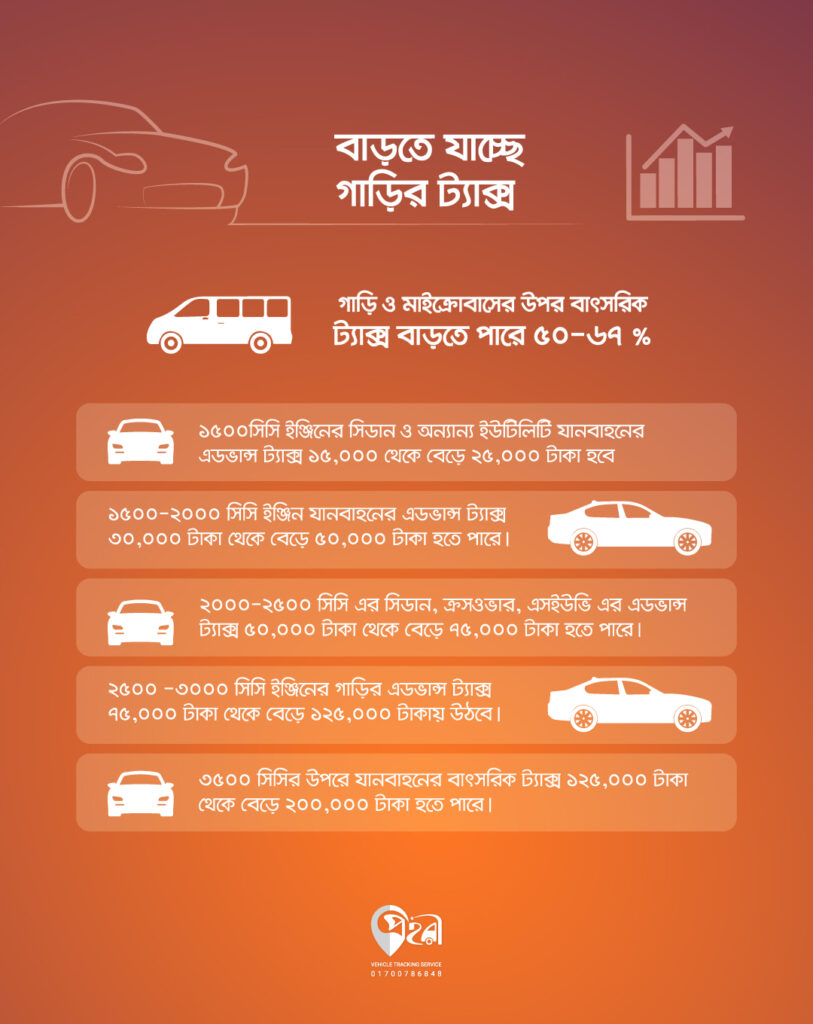

What is Car Tax in Bd 2022?

In Bangladesh, car tax is an annual tax levied on the ownership of motor vehicles. The amount of tax varies depending on the type and size of vehicle.

For cars with engines up to 1000cc, the tax is Tk 5,000 per year.

For cars with engines between 1000cc and 1500cc, the tax is Tk 10,000 per year. For cars with engines between 1500cc and 2000cc, the tax is Tk 15,000 per year. And for cars with engines over 2000cc, the tax is Tk 20,000 per year.

The government has also introduced a new system of levying taxes on imported vehicles. Under this system, a customs duty of 50% will be imposed on all imported vehicles regardless of their engine size.

Credit: www.newagebd.net

1,500 Cc Car Yearly Tax in Bangladesh

As of 2019, the yearly tax for a 1,500 cc car in Bangladesh is Tk. 20,000. This amount is subject to change based on the value of the vehicle and other factors.

Bangladesh Car Tax Calculator

Are you looking to calculate the taxes on your car in Bangladesh? If so, you’ve come to the right place! This blog post will provide all of the information that you need in order to calculate your car tax in Bangladesh.

First, let’s start with some basics. The government of Bangladesh imposes a 15% tax on the sale of all new cars. So, if you’re buying a new car, you can expect to pay an additional 15% on top of the purchase price.

Now, let’s say you want to buy a used car. The tax rate for used cars is slightly different. First, there is a 5% import duty that must be paid when bringing a used car into Bangladesh.

In addition to this, there is also a 10% value-added tax (VAT) that applies to all used cars. So, if you’re buying a used car, you’ll need to add up these two taxes (import duty and VAT) to get the total amount of taxes that you’ll owe.

Finally, let’s say you’re leasing a car.

The tax rate for leased cars is the same as it is for new cars (15%). However, there is one additional fee that must be paid when leasing a car: the registration fee. This fee varies depending on the make and model of the vehicle being leased, but it typically ranges from 1-2%.

So, if you’re leasing a car in Bangladesh, be sure to factor in this additional fee when calculating your taxes.

Car Import Tax in Bangladesh

If you’re planning on importing a car into Bangladesh, be aware that there is a substantial import tax. The import tax is based on the value of the car, and can range from 50% to 100% of the value of the vehicle. So, if you’re thinking of importing a car worth $20,000, you could end up paying as much as $40,000 in taxes.

There are some ways to reduce the amount of import tax you’ll have to pay, such as using a registered importer or choosing a less expensive car, but ultimately you’ll need to be prepared to pay this significant fee.

Conclusion

The amount of car tax in Bangladesh varies depending on the type and size of the vehicle. For example, a small car may be subject to a tax ofBDT 1,500 while a larger car may be subject to a tax of BDT 3,000.

- Get Business & Edu Tips daily