Are you in need of a car insurance policy for just one day? Perhaps you are planning a short road trip, borrowing a friend’s car, or simply need temporary coverage. Whatever your reason may be, it’s essential to understand the options available to you.

Temporary Car Insurance Explained

When it comes to insuring your car for a single day, you might be surprised to learn that most insurance companies do not provide specific one-day insurance policies. Instead, they offer temporary car insurance that typically covers your vehicle for a minimum term of six months.

This type of insurance is often used in situations where standard annual or semi-annual policies are not suitable, such as when you need coverage for a short period of time, like one day.

Availability in Texas

If you’re in Texas and require temporary car insurance for just a day, it’s important to note that obtaining insurance for such a short duration may present some challenges. Typically, in Texas, you may have to purchase a six-month policy and cancel it mid-term when you no longer need the coverage.

While some insurers may charge a cancellation fee, you can usually receive a refund for any unused coverage time you’ve prepaid for. It’s essential to discuss this option with your insurer and understand the associated costs and procedures.

Options for Temporary Coverage

If you find yourself needing insurance for only one day, there are a few options available to you:

- Purchase a six-month policy and cancel it after one day of coverage, if allowed by your insurer.

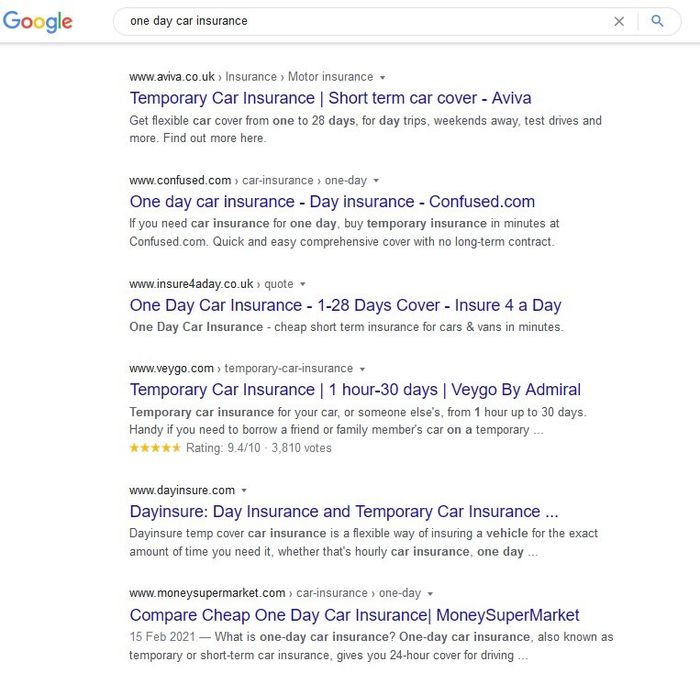

- Explore the possibility of obtaining temporary coverage through specialized insurance providers that cater to short-term insurance needs.

Credit: medium.com

Considerations and Alternatives

It’s important to note that driving a car without insurance is illegal in Texas. Therefore, if you plan to drive a car that is not yours, even if it belongs to friends or family, you need insurance coverage.

Consider discussing the option of being added as a named driver on the owner’s insurance policy or explore alternative insurance providers that offer temporary coverage for short durations.

Credit: twitter.com

Final Thoughts

As you search for options to insure your car for just one day, remember to explore the available alternatives, including discussions with your insurance provider and specialized short-term coverage options. By understanding the available choices and staying compliant with the legal requirements, you can ensure a safe and protected driving experience, even for just a day.

Remember to always consider the legal requirements of your state, in this case, Texas, and discuss your unique situation with insurance experts to make well-informed decisions.

Frequently Asked Questions On Insurance On A Car For 1 Day: Flexibility And Coverage

What Is The Shortest Time You Can Insure A Car?

The shortest time you can insure a car is typically for a minimum term of six months. Insurance companies do not provide one-day insurance policies, but you can purchase temporary car insurance. This allows you to cancel the policy when you no longer need coverage, and you may receive a refund for any unused coverage time.

Be cautious of insurers offering one-day car policies, as they are not commonly available.

Can You Get Temporary Car Insurance In Texas?

Yes, you can get temporary car insurance in Texas by purchasing a six-month policy and canceling when no longer needed.

Who Is The Cheapest Car Insurance In Texas?

The cheapest car insurance in Texas depends on the type of coverage you’re looking for. State Farm offers the cheapest liability-only auto insurance, while Texas Farm Bureau has the cheapest full coverage. Remember to compare rates and options to find the best fit for your needs.

Am I Insured To Drive Any Car?

You must have insurance to legally drive a car not owned by you. Get named on the existing policy, opt for temporary coverage or have your own policy with DOC.